AdviceCafé: Brewing Affordable Financial Advice for Canadians

What is it?

AdviceCafé is a place where anyone can grab a cup of unbiased financial advice without worrying about being sold a financial product.

This advice-only offering is available for an annual fee of $249 +tx, to anyone who’s looking for general financial advice so they can get more life from their money. It takes as little as 10-20 minutes to get started, and you could be making meaningful financial change within 30 days.

No product sales. No commissions. No pressure.

What are some typical topics we help members with?

-

Cash Flow & Debt Management

- Behaviour-based cash flow management concepts

- Understanding the cost of debt including mortgages, new purchases, and re-financing

- Debt management concepts

-

Financial & Retirement Planning

- Understanding and building your credit

- Understanding different types of investments and how various account types work (RRSPs, TFSA, FHSA, LIRA)

- The differences between Defined Contribution and Defined Benefit Pension plans

- How to stay on top of your estate planning, wills, power of attorney, and health directives

-

Benefits & Insurance

- How life insurance, critical illness and disability insurance work

- Making the most of your employee benefits plans, coverage and claims

What about working with my existing financial advisor?

AdviceCafé doesn’t replace your relationship with your existing advisor or institution. You can take what you learn by working with one of our advisors and apply it with an existing financial professional, or use it to manage things on your own.

How does it work?

When you sign up to be a member of AdviceCafé you are immediately provided with unlimited access to the following:

-

Live Support & Personalized Financial Tools

- LIVE AdviceChat (8am-8pm Central Time) to ask any financial question. Automated responses cover common inquiries, while our experts handle more complex issues.

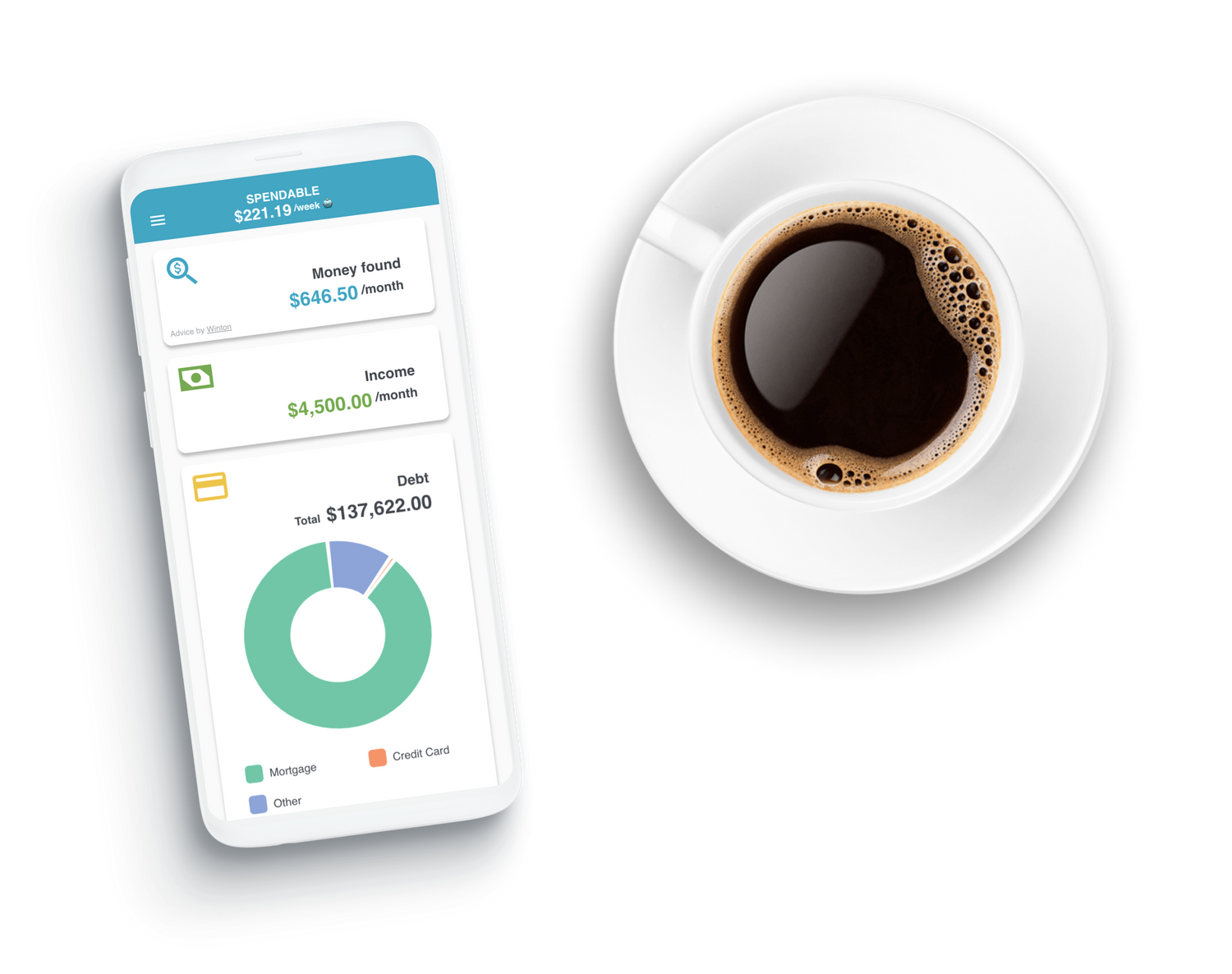

- Winton App helps you build a comprehensive financial profile so the professional assigned to your case can better understand your current financial situation and provide tailored advice.

-

Digital Resources & Learning

- SideDrawer App offers secure document storage with 256-bit encryption (higher than many banks), file sharing, and seamless collaboration with other professionals, ensuring privacy and efficiency.

- The Morning Brew is a monthly digital e-newsletter from AdviceCafé, packed with timely and informative financial topics to keep you updated.

- AdviceCafé Financial Learning Library offers a variety of action-based, interactive eLearning courses and videos, helping you gain the knowledge to become more financially aware and confident.

-

Member Benefits & Exclusive Services

- 15% Discount on all a la carte services, including comprehensive financial planning for individuals, families, and business owners, audits (investment portfolios, insurance, mortgages), legal services (wills, POA, estate planning), and CRA tax preparation (personal and corporate).

- Exclusive Access to AdviceCafé-branded merchandise as an added perk for being part of our community.

No product sales. No commissions. No pressure.

Our advisor will recommend specific included financial eLearning materials you can access to enhance your understanding and implementation of our advice and never sell you financial products of any kind.

What is the Winton app included with AdviceCafé?

The Winton App helps clients create a personalized financial profile before their initial consultation. This allows our advisor to better understand their financial situation and provide tailored, non-product advice on topics such as budgeting, debt management, saving for short-term and long-term goals, and planning for retirement. The app supports clients in tracking progress and accessing relevant financial learning resources.

Our Financial Baristas are ready and waiting to serve you

Financial advice provided by AdviceCafé to its members is delivered by a team of Financial Baristas, who are highly experienced financial planners, all of whom possess extensive real world financial planning experience, and who carry one or more of the following designations: Certified Financial Planner (CFP), Qualified Associate Financial Planner (QAFP), Chartered Life Underwriter (CLU), Certified Cash flow Specialist (CCS), and/or Real Wealth Manager (RWM).

Blog posts

-

Saving for your first home with a FHSA

For many individuals, owning a home is a significant milestone and a cornerstone of financial stability. However, saving for a down payment can be a daunting task, especially for first-time homebuyers. To address...

Saving for your first home with a FHSA

For many individuals, owning a home is a significant milestone and a cornerstone of financial stability. However, saving for a down payment can be a daunting task, especially for first-time homebuyers. To address...